What is Stripe and Why Should We Care?

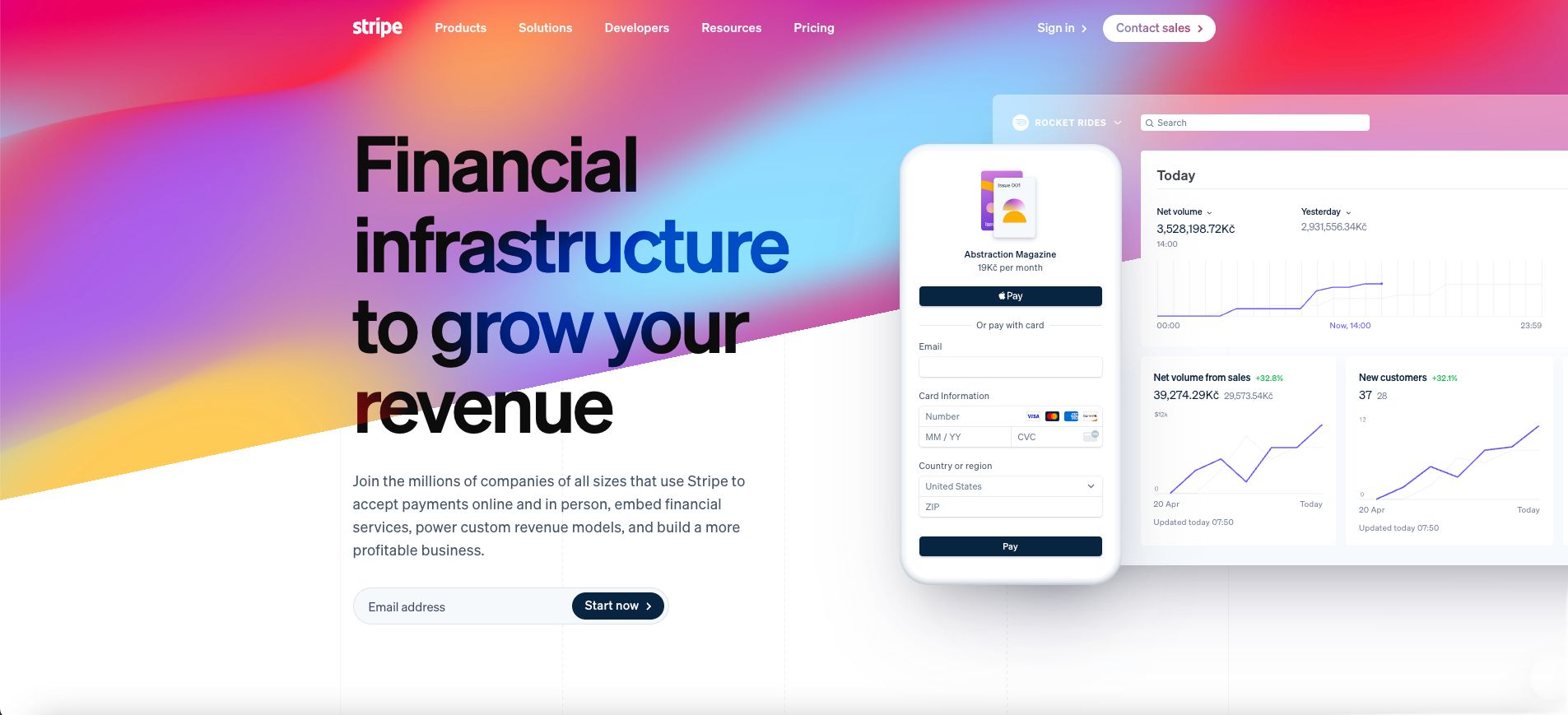

In the world of online payments, several major players dominate, including PayPal, Adyen, and Square. One of the most significant among them is Stripe—a company many everyday users are unaware of, despite using its services daily. Stripe operates behind the scenes, processing payments for e-commerce stores, mobile apps, and various online platforms.

Founded in 2010 by brothers Patrick and John Collison, Stripe has grown into one of the largest fintech startups globally. It specializes in providing payment infrastructure for businesses and developers. Some of its major clients include Amazon, Shopify, Google, Uber, and many others.

Stripe and Its Potential IPO

Stripe is one of the most valuable private fintech startups. In 2021, its valuation reached $95 billion, but later declined to $50 billion in 2023. Despite this fluctuation, it remains a dominant player in the digital payments industry.

While Stripe has not yet decided to go public, speculation suggests that an IPO could be one of the biggest in fintech history. If it were to happen, it would likely attract significant interest from investors looking at innovative companies in the digital payments space.

Stripe vs. Publicly Traded Fintech Stocks: How Does It Compare?

Stripe competes with several key players in the payments sector:

- PayPal ($PYPL) – Focuses on consumer transactions, whereas Stripe primarily serves businesses.

- Adyen ($ADYEN) – Similar to Stripe, it targets large e-commerce enterprises.

- Square (Block) ($SQ) – Strong in the small and medium-sized business sector but less globally integrated.

If Stripe were to go public, it would immediately become a competitor to these companies and could attract investors looking for a high-growth fintech stock.

How Can Investors Get Exposure to Stripe Today?

Since Stripe is not yet publicly traded, regular investors cannot buy its stock directly. However, there are some indirect ways to gain exposure:

- Investing through venture capital (VC) funds – Stripe has received backing from major investment firms such as Sequoia Capital and Andreessen Horowitz.

- Buying shares of companies that rely on Stripe – Stripe is a primary payment partner for businesses like Shopify ($SHOP), which could serve as an alternative investment option.

Stripe and Cryptocurrencies: Is It Part of the Fintech Revolution?

Stripe initially took a cautious approach toward cryptocurrencies but announced its return to the sector in 2022. Today, it enables merchants to accept USDC stablecoin payments via Ethereum, Solana, and Polygon blockchains.

Additionally, Stripe acquired Bridge, a startup specializing in stablecoin transactions, suggesting that it could play a larger role in the future of digital payments. However, Stripe remains primarily focused on fiat currencies and traditional payment methods.

Conclusion and Final Thoughts

Stripe is a major player in online payments, but its decision to remain private sets it apart from other fintech giants. While companies like PayPal and Square are publicly traded, Stripe maintains its flexibility and independence.

If Stripe eventually goes public, it could become one of the most exciting investment opportunities in fintech. However, it is crucial to note that there is no official IPO plan yet, and any investment decision should be based on thorough research and evaluation of available information.