Smart ETF Selection & Overlap Prevention

Investing in ETFs is a great way to diversify a portfolio and reduce risk. However, beginner investors often make the mistake of buying multiple ETFs with similar compositions, leading to excessive overlap. This article explains how to choose ETFs wisely to avoid duplicate investments and build an efficient portfolio.

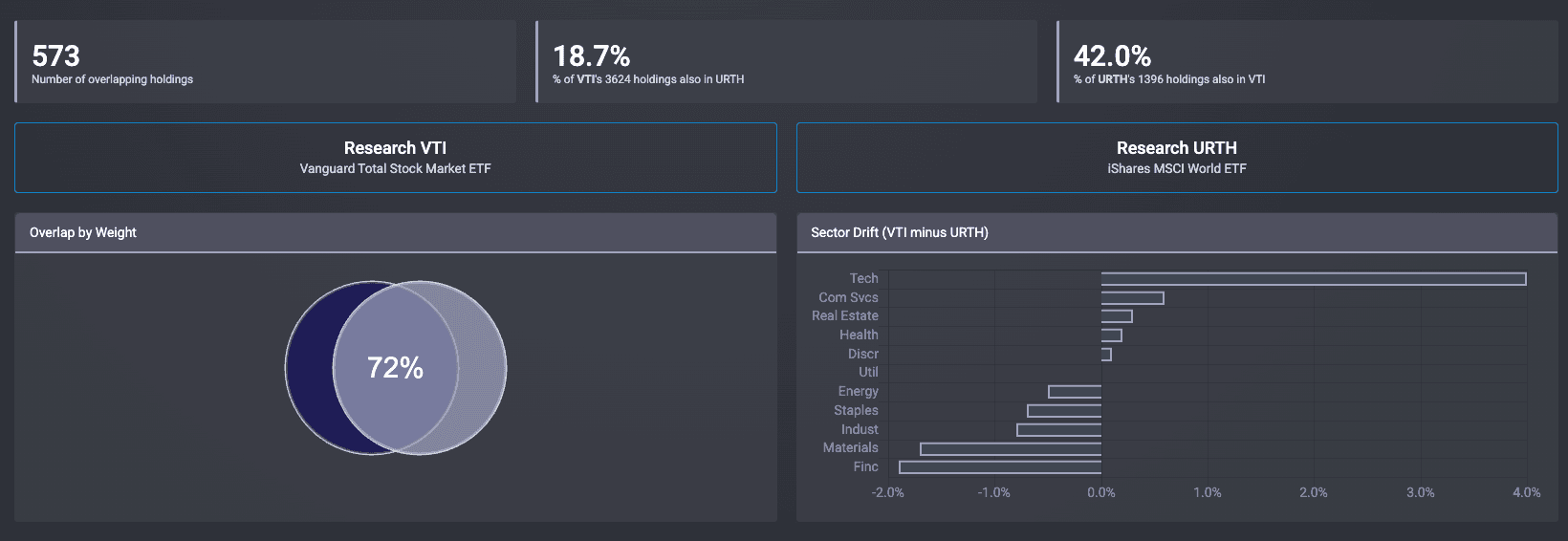

Understanding stock overlap between ETFs is essential. When the same stocks appear in multiple funds, investors may unknowingly concentrate their portfolio in a few key holdings. For example, investing in an S&P 500 ETF and a global ETF such as MSCI World will likely result in significant overlap in major companies like Apple, Microsoft, or Amazon. This can lead to insufficient diversification, increased risk, and unnecessary costs without additional benefits. Monitoring ETF compositions helps avoid redundancy and ensures better exposure across different sectors and regions.

The first step in selecting ETFs is defining an investment strategy. Investors should determine whether they seek broad market exposure, focus on specific sectors, or prefer international diversification. Growth, value, and dividend investing approaches also influence the choice of ETFs. Once an investor has a strategy, choosing core ETFs becomes simpler. Broad market ETFs such as the Vanguard Total Stock Market ETF (VTI) or iShares MSCI World ETF (URTH) provide extensive exposure. For diversification outside the U.S., adding Vanguard FTSE All-World ex-US ETF (VEU) is an option. However, buying multiple ETFs with similar focus, such as SPY and VOO, can be redundant.

To minimize stock overlap, investors can use tools like Morningstar Portfolio X-Ray to analyze stock allocations within ETFs. The ETF Research Center Overlap Tool compares two ETFs to reveal the percentage of duplicated holdings. If overlap exceeds 70%, it may be worth reconsidering one of the ETFs or seeking a fund with a different composition. Additionally, while holding individual stocks is not inherently problematic, it is important to ensure they do not overly replicate ETF holdings. For example, owning Apple while also investing in an S&P 500 ETF still provides broad market exposure, but adding another technology-heavy ETF may be unnecessary. Instead, investors can look for ETFs that complement their holdings by focusing on other sectors or themes.

Consider a beginner investor aiming for a balanced portfolio. If they buy SPY (S&P 500 ETF), QQQ (Nasdaq 100 ETF), and VGT (Vanguard Technology ETF), their portfolio will be heavily concentrated in Apple, Microsoft, Nvidia, and Google. To achieve better diversification, they might choose VTI (Vanguard Total Stock Market ETF) for overall U.S. market exposure, VEU (Vanguard FTSE All-World ex-US ETF) for international diversification, and VNQ (Vanguard Real Estate ETF) for real estate exposure. This approach reduces overexposure to a single group of stocks and spreads risk more effectively.

Choosing ETFs wisely means not only monitoring their performance and costs but also ensuring they do not heavily overlap. Tools like Morningstar X-Ray and ETF Overlap Tool help identify potential issues, making it easier to diversify effectively. For beginner investors, the key rule is simple: fewer ETFs with better diversification. Avoiding unnecessary overlap leads to a more balanced and efficient long-term portfolio.

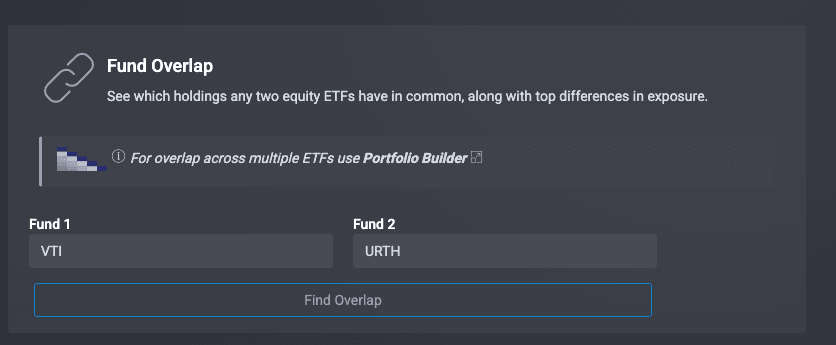

Quick Guide to Using the ETF Overlap Tool

-

Open the Page

Go to the ETF Overlap Tool page. -

Enter ETF Tickers

For this example, we used SPY and QQQ. Enter the tickers in the designated input fields.

-

View the Results

The tool will immediately display the overlap percentage and a breakdown of shared holdings.

This simple process helps investors quickly assess ETF redundancy and make informed decisions.

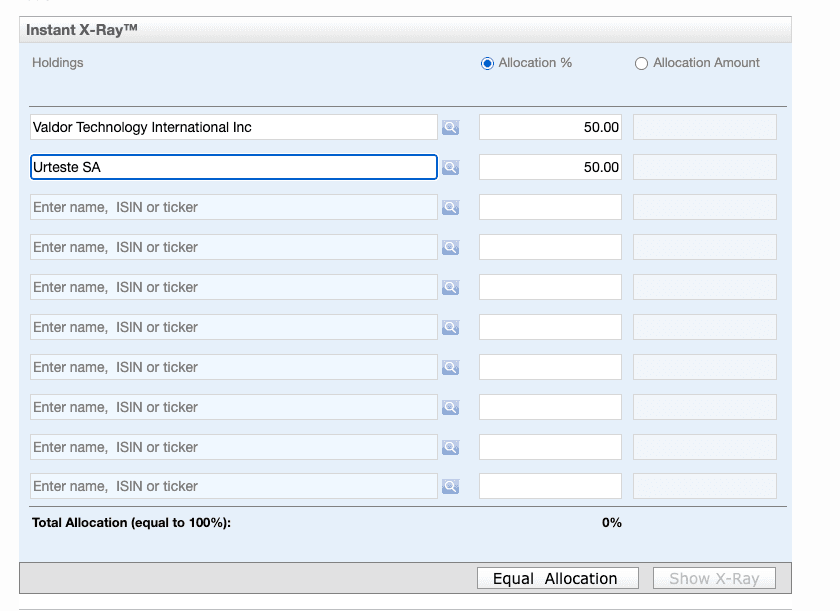

How to Manually Enter Holdings in Morningstar X-Ray

-

Open the Page

Go to the Morningstar Portfolio X-Ray page. -

Enter Stock or ETF Names

- In the first column, manually type the name, ISIN, or ticker of the stock or ETF you own.

- For example, enter "Valdor Technology International Inc" in the first row.

- In the second row, enter "Urteste SA".

- Continue adding any other assets you hold.

-

Assign Allocation Percentages

- In the column to the right, specify what percentage of your portfolio each asset represents.

- In this example, both stocks are assigned 50% each.

-

Complete Your Portfolio

- Add more holdings if necessary, ensuring the total allocation equals 100%.

-

Run the X-Ray Analysis

- Once all assets are entered, click "Show X-Ray" to generate the report.

This method allows investors to manually enter their portfolio holdings and get a deeper analysis of their stock and sector exposure.

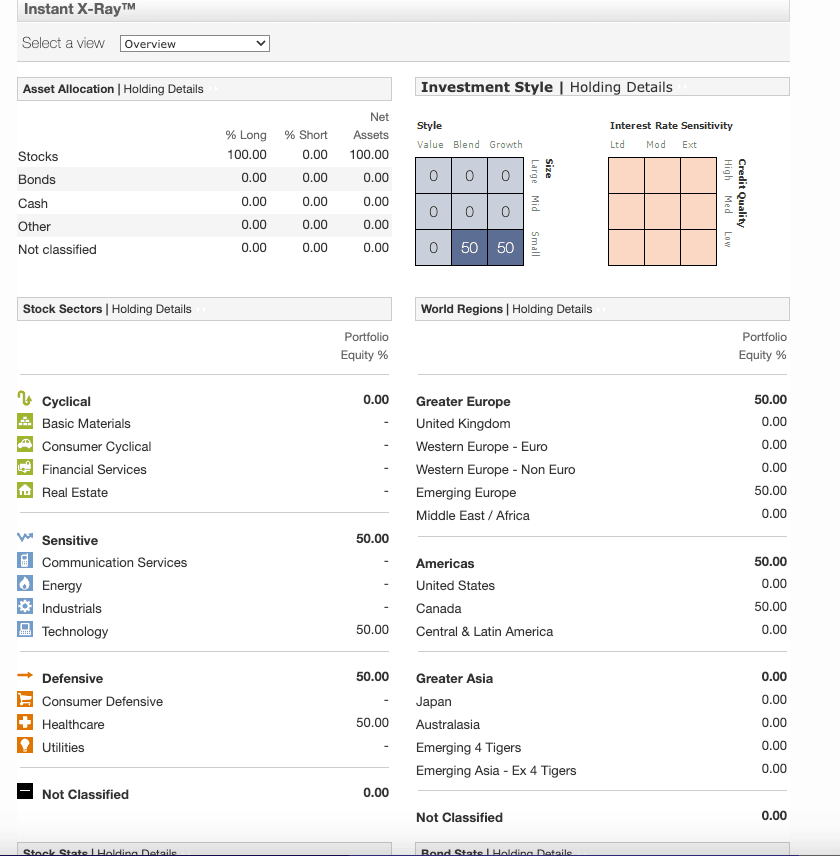

View Your X-Ray Results

After clicking "Show X-Ray", you will see a detailed breakdown of your portfolio.

I hope this guide has helped you better understand how to analyze your portfolio and manage risk effectively.

Note

Many of the tools mentioned, such as Morningstar X-Ray and ETF Research Center, may have restrictions or require a subscription for full functionality. Investors should consider these limitations when using them.