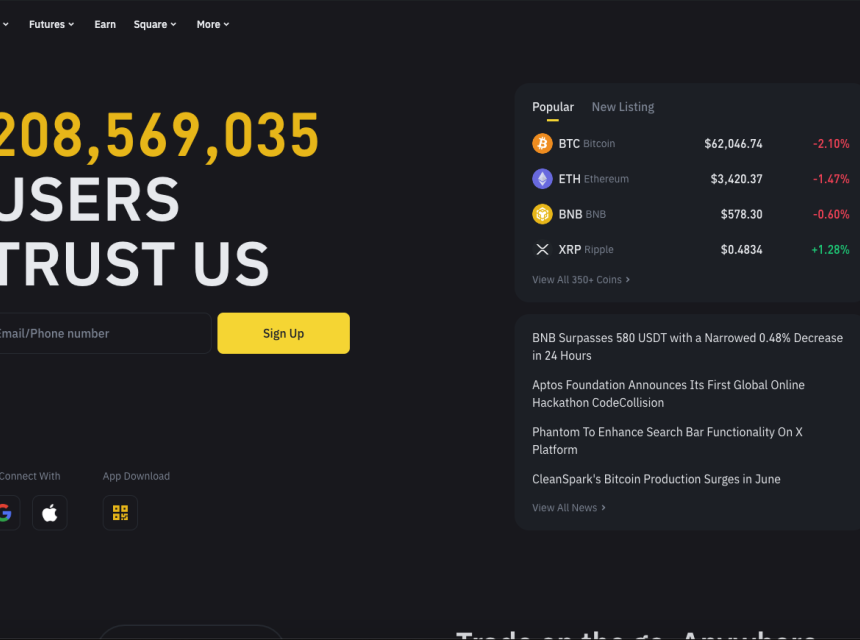

Circle has received authorization to issue USDC as an electronic money token (EMT) compliant with the Markets in Crypto-Assets (MiCA) regulations, effective from July 1, 2024. This significant achievement makes USDC the first major regulated stablecoin in the European Economic Area (EEA). The regulation ensures that USDC will continue to be available across various Binance product offerings, providing users with a secure and compliant stablecoin option.

USDC will remain available for trading on the Binance Exchange, where users can buy and sell the token, as well as exchange other stablecoins for USDC. In the realm of Binance Earn products, subscriptions to USDC will continue for services like Simple Earn, cloud mining, and the Web 3.0 Earn wallet. These products include all features of auto-subscription, ensuring consistent availability for users.

The authorization also means that USDC can still be used for loan applications on Binance, with the token available for use as collateral for various loan products, including VIP loans. Additionally, referral commissions and most platform rewards on Binance will be paid out in USDC, further integrating the stablecoin into the Binance ecosystem.

For fiat purchases, users can continue to buy USDC with local currencies, including through credit card transactions. Recurring purchase plans will automatically convert to USDC, ensuring seamless transitions for users. Margin trading options will also remain unchanged, allowing for the transfer of USDC as margin collateral and borrowing within margin products.

Finally, peer-to-peer (P2P) trading of USDC on Binance will continue to be supported, maintaining liquidity and accessibility for users. This regulatory milestone solidifies USDC's position in the EEA, offering enhanced security and compliance for stablecoin transactions.