Starting with Stock Investments

Starting with Stock Investments

Welcome to Your Comprehensive Guide to Stock Investments

Unlock the World of Stock Trading

Investing in stocks offers a fascinating avenue to potentially build wealth and participate in the financial successes of the world's leading companies. While the potential for significant returns is attractive, it's important to remember that all stock market investments carry risks. Understanding these risks and how to manage them is crucial for sustaining your investment journey. This guide is designed to equip you with the necessary knowledge to navigate the complexities of the stock market confidently.

What Are Stocks?

Stocks represent ownership shares in a company. When you purchase a stock, you're buying a piece of that company, including the right to a portion of the earnings and assets. As the company grows and succeeds, so does the value of your investment.

Why Invest in Stocks?

The stock market has historically provided higher average returns than other forms of investments, such as bonds or savings accounts. Investing in stocks is widely regarded as a cornerstone to building long-term wealth. Whether you're looking to fund retirement, increase your financial security, or capitalize on business growth, stocks can be a valuable addition to your investment portfolio.

Starting Your Investment Journey

Before you dive into buying stocks, it's crucial to understand how the stock market operates, the strategies successful investors employ, and the risks involved. Educating yourself through online courses, books, and financial news websites is essential. Beyond the basics, learning to perform a thorough analysis of potential investments is key. This includes understanding financial statements and using valuation models like the Discounted Cash Flow (DCF) model to estimate the intrinsic value of a stock. This model helps determine the present value of an investment's expected future cash flows, providing insight into whether a stock is overvalued, undervalued, or fairly priced.

Let's embark on this financial adventure where we'll decode the essentials of stock trading, explore effective investment strategies, and learn how to manage risks intelligently.

What to Watch in Stocks

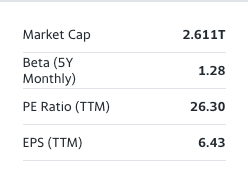

Market Cap

This represents the total market value of a company's outstanding shares and is calculated by multiplying the current market price of its shares by the total number of shares outstanding. It gives investors a rough estimate of the company’s size.

Basic Metrics

- P/E (Price-to-Earnings Ratio): Compares the current share price to its earnings per share (EPS). A lower P/E might indicate that the stock is undervalued, whereas a higher P/E can suggest overvaluation.

- EPS (Earnings Per Share): The company's total earnings divided by the number of outstanding shares. It indicates how much money a company makes for each share of its stock.

- Dividend Yield: The percentage a company returns to its shareholders in the form of dividends. A higher yield can be attractive to income-seeking investors.

P/B (Price-to-Book Ratio): Compares the market price of a stock to its book value per share. Values under 1 may suggest undervaluation, while values above 1 can indicate overvaluation.

- ROE (Return on Equity): Measures a company’s profitability by showing how much profit it generates with the money shareholders have invested. A higher ROE indicates efficient use of investor funds.

ROI (Return on Investment): ROI measures the overall profitability of an investment as a percentage of the original costs, offering an intuitive indicator of how much return each invested dollar generates. This metric is particularly useful for investors to quickly evaluate and compare different investment opportunities, helping them assess the effectiveness of their investments and see how well individual investments have performed relative to alternatives.

- ROIC (Return on Invested Capital): ROIC indicates how much profit a company generates for every dollar of invested capital, with a higher ROIC suggesting a more efficient use of capital. This metric is crucial for evaluating companies with significant capital investments, providing investors and analysts with essential insights into how efficiently a company uses its capital to generate profits. It is fundamental in assessing a company’s long-term sustainability and competitive advantage.

Beta: A measure of a stock's volatility in relation to the overall market. A beta greater than 1 indicates that the stock is more volatile than the market, while a beta less than 1 means it is less volatile.

Growth and Stability

- Yearly Revenue and Profit Growth: How quickly a company is growing its revenues and profits year over year.

- Earnings Stability: The consistency of a company's profits over time.

Debt

- Debt-to-Equity Ratio: The extent to which a company is financed through debt versus its own equity. A higher ratio may indicate a higher risk of financial distress.

Liquidity

- Quick Ratio: Indicates how well a company can meet its short-term liabilities with its most liquid assets.

Brokers by Region:

- Europe: Interactive Brokers, DEGIRO, Trading 212

- USA: Interactive Brokers, Fidelity Investments, E*TRADE

- Asia: Zerodha (India), Rakuten Securities (Japan), HSBC (Hong Kong)

Risk Management: Essential for Every Investor

Effective risk management is crucial, regardless of whether you are a day trader or a long-term investor. Here's how to approach risk management in a way that suits various investment styles:

Understand Your Risk Tolerance

Risk Assessment: Assess your financial goals, timeline, and how much market fluctuation you can tolerate without panicking. This will help guide your investment choices and ensure they align with your comfort level and financial objectives.

Key Strategies for Managing Investment Risks

- Diversification: Reduce risk by spreading your investments across different stocks, sectors, and even asset classes. Diversification helps mitigate the impact of poor performance in any single investment.

- Position Sizing: Carefully decide how much of your total capital to invest in a particular stock or sector. Appropriate position sizing is crucial to managing risk effectively, ensuring that no single investment can significantly harm your overall portfolio.

Staying Informed and Making Adjustments

- Monitor News and Market Trends: Keeping up with news and events related to the companies in your portfolio is essential. Significant company announcements and broader market trends can have immediate impacts on stock prices. Understanding these factors is crucial for making informed investment decisions.

- Regular Portfolio Reviews: It's important to regularly review your portfolio to ensure it aligns with your risk tolerance and investment goals. As market conditions change or as financial goals evolve, adjusting your holdings can help maintain a balanced and appropriate investment approach.

- Proactive Adjustments: Be proactive about your investment strategy. Respond to new information and changes in the market by adjusting your portfolio as needed. This not only helps in capitalizing on opportunities but also in mitigating potential risks.

Managing Emotions

- Emotional Discipline: Maintaining discipline in your investment strategy is key, especially during market volatility. Avoid making impulsive decisions based on short-term market movements. Stick to your long-term investment strategy unless fundamental changes necessitate a reassessment.

Final Advice for Beginners

- Be Patient and Disciplined: Successful stock trading doesn't happen overnight. It takes time, research, and discipline to learn the ropes and make informed decisions.

- Consider Fees and Taxes: Be aware of brokerage fees, transaction costs, and taxes, as they can affect your overall returns.

And again, I remind you: Only invest what you can afford to lose. This prudent approach will help safeguard your financial well-being.